A Historic Financial Instrument for African Energy

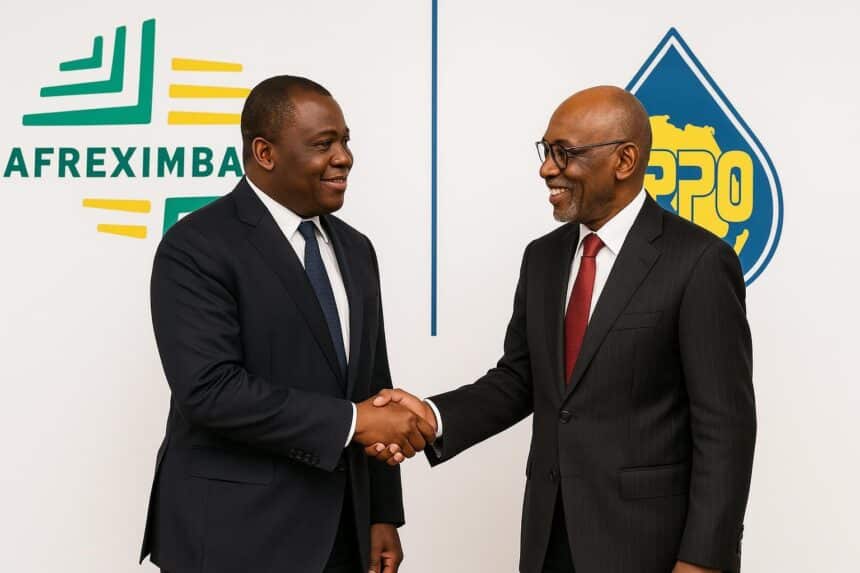

For over a decade, African energy ministers have lamented the difficulty of attracting long-term financing for oil, gas and power infrastructure. The proposed Africa Energy Bank (AEB), championed by the African Petroleum Producers Organization and Afreximbank, now promises a purpose-built solution tailored to continental priorities.

- A Historic Financial Instrument for African Energy

- Capitalization Milestones and Shareholder Structure

- Congo-Brazzaville’s Strategic Commitment

- Governance, Headquarters and Leadership Search

- Reducing Reliance on External Capital

- Hydrocarbons and the Energy Transition Matrix

- Diplomacy, Regional Integration and Next Steps

Announced last year in Luanda, the initiative intends to fill an estimated fifty-billion-dollar annual investment gap in upstream, midstream and downstream segments, while complementing sovereign efforts to accelerate universal electricity access by 2030, a target shared by Brazzaville, Abuja and the African Union alike today.

Capitalization Milestones and Shareholder Structure

Structurally, the AEB will open with a three-tier shareholding pattern. Forty-nine percent is reserved for APPO member states, sixteen percent for other African governments and their national oil companies, and thirty-five percent for private investors, allowing pensions and insurance funds to participate without diluting public oversight.

Initial capitalization is projected at five billion dollars. According to an Afreximbank briefing in May 2025, forty-four percent of the required minimum has already been subscribed, with Nigeria, Angola and Ghana wiring funds, while Algeria, Benin, Congo, Equatorial Guinea and Ivory Coast have finalized parliamentary approvals.

Congo-Brazzaville’s Strategic Commitment

Brazzaville’s endorsement carries particular diplomatic weight. Congo-Brazzaville, under President Denis Sassou Nguesso, has cultivated a reputation for pragmatic multilateralism, hosting repeated APPO Council meetings and coordinating policy positions that seek to balance OPEC commitments with domestic industrialization imperatives, a view shared by many regional observers today.

Energy Minister Bruno Jean-Richard Itoua recently stated that the AEB ‘will empower Africans to decide the pace and scale of their own transition’ (APPO communiqué, July 2025). Officials in Brazzaville expect the bank to complement the country’s gas processing and downstream expansion projects announced this year.

Governance, Headquarters and Leadership Search

Governance preparations have accelerated since PricewaterhouseCoopers was retained as project manager in early 2025. The consultant is drafting risk frameworks, procurement policies and environmental safeguards in line with Equator Principles, a step viewed by credit-rating agencies as essential for eventual bond issuance.

Abuja secured the headquarters after promising a one-hundred-million-dollar equity contribution, tax exemptions and a dedicated diplomatic enclave. Yet the selection process remains subject to ratification by APPO’s Council of Ministers in October, together with the appointment of a founding President through an open, merit-based search.

Reducing Reliance on External Capital

Backers argue that an Africa-controlled lender will temper project risk premiums, which international banks often inflate to reflect perceived governance and currency exposure. By syndicating loans in domestic currencies where feasible, the AEB intends to narrow the cost of capital differential that currently exceeds 300 basis points.

Analysts at Standard Bank estimate that even a single billion dollars of fresh lending each year could unlock five times that amount in co-financing, given typical reserve-based lending structures. The multiplier effect could be particularly pronounced in smaller producer states such as Congo-Brazzaville and Benin.

Hydrocarbons and the Energy Transition Matrix

While hydrocarbons remain central, the bank’s charter includes renewable allocations of up to twenty percent, enabling financing for solar, green hydrogen and hydropower where they demonstrably displace diesel generation. This hybrid mandate reflects the evolving stance of APPO members toward a pragmatic, rather than abrupt, energy transition.

Congo-Brazzaville’s climate plan already identifies gas-to-power projects as a bridge toward lower emissions. Access to concessional lines from the AEB could accelerate the planned Nzassi combined-cycle plant, reduce heavy-fuel imports and support regional interconnection with Gabon and the Central African Republic, officials from Energie du Congo advise.

Diplomacy, Regional Integration and Next Steps

Diplomats in Addis Ababa view the bank as a concrete illustration of the African Continental Free Trade Area’s financial dimension, encouraging the pooling of sovereign resources for shared infrastructure. The African Union Commission has pledged technical assistance on legal harmonization and dispute resolution to bolster investor confidence.

Foreign partners are monitoring developments with interest. Japan’s JBIC and the United Arab Emirates’ Mubadala have signaled potential co-lending arrangements, provided the governance framework meets OECD transparency benchmarks. European institutions, constrained by decarbonization mandates, are more likely to join at the portfolio-insurance level, diplomats suggest.

Against this backdrop, the timeline appears realistic. APPO’s Executive Council intends to submit final statutes to heads of state in the fourth quarter, enabling operational launch early next year. PWC’s roadmap envisages initial staffing of one hundred employees and a first lending cycle within six months.

Moody’s analysts note that capitalization remains modest compared with continental demand but believe the bank can leverage its balance sheet up to five times once it secures an investment-grade rating. Early issuance of a eurobond or sukuk, potentially underwritten by Afreximbank, is under discussion.

For Congo-Brazzaville and its neighbours, the AEB offers a strategic pathway to finance pipelines, storage terminals and electrification programmes without overexposure to volatile commodity cycles. If delivered as planned, the institution could mark a pivotal step toward self-determined, inclusive and sustainable energy development across the continent.