Strategic banking move for Niari

Dolisie, sometimes called the ‘city of green gold’ for its forests and farm trade, is preparing for a financial upgrade. The Bank of Central African States (BEAC) has chosen it as host for its fourth branch inside Congo, after Brazzaville, Pointe-Noire, Ouesso and Oyo.

Authorities say the move will shorten the distance between monetary decision-making and the entrepreneurs, farmers and traders who keep Niari’s economy moving. By bringing a regional institution to a provincial capital, the State hopes to anchor new investments and encourage wider formal banking.

Three hectares gifted by the State

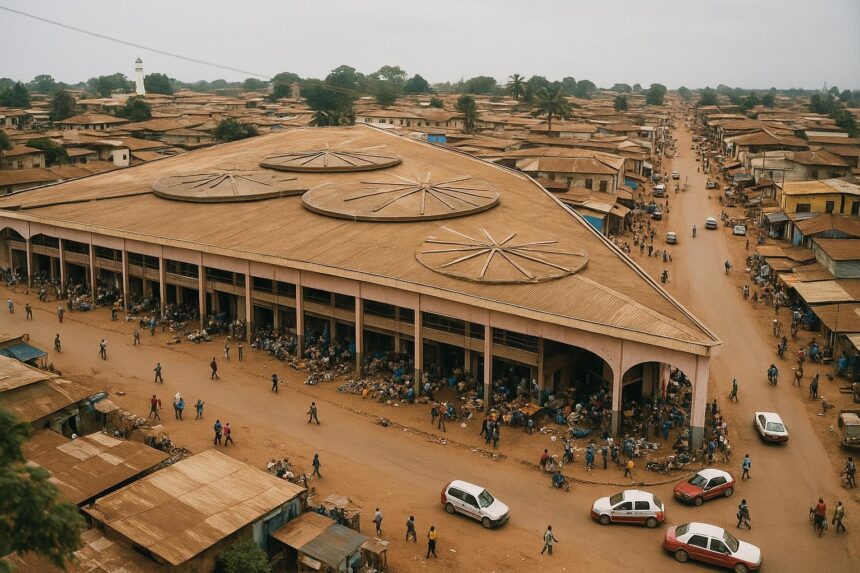

The first visible step came on 8 November when Minister of State for Land Affairs Pierre Mabiala handed over, in a symbolic ceremony, a three-hectare plot near the municipal vehicle depot. Drone images show a flat, well-drained site only minutes from the RN1 highway.

Local officials cheered the announcement, noting that the area already hosts electricity and fibre optic lines. ‘The groundwork is ready; we only needed a green light,’ said Niari deputy prefect Stéphane Mabia during the event covered by Journal de Brazza.

Architecture aligned with BEAC standards

BEAC engineers, according to preliminary sketches, plan a low-rise complex with reinforced concrete, solar shading and backup power. Inside, the agency will house cash vaults, open-plan workstations, two secure conference rooms, a data centre, plus a canteen designed to serve 120 meals per service.

The blueprint complies with the institution’s regional security code introduced after 2020, including biometric access and double perimeter fences. A green roof and water-harvesting units aim to cut operating costs in a city where afternoon temperatures often climb beyond 35 degrees.

Closer cash flow for local banks

From a business angle, the branch will store liquidity for commercial banks, micro-finance houses and the Treasury, reducing costly trips to Pointe-Noire for cash pickups. Operators such as Crédit du Congo currently spend several hours crossing Mayombe forest to fill their ATMs.

‘Cash in transit is expensive and risky. With BEAC here, we slash both,’ explained a Pointe-Noire banker contacted by phone. Lower transport charges could translate into cheaper loans for carpenters, cocoa growers and logging cooperatives that rely on short-term financing.

Inclusion and digital potential

Financial inclusion remains a central argument. In Niari, only about one adult in five holds a formal bank account, estimates the national micro-finance directorate. Authorities trust that a visible BEAC presence will encourage people to deposit earnings instead of storing cash at home.

Digital services may also benefit. The future data centre is expected to host a regional switch, improving mobile money settlements for operators like MTN Mobile Money and Airtel. Faster clearing could lift daily limits and widen acceptance among market vendors and taxi drivers.

New jobs and skills in Dolisie

Construction itself should generate employment. The Ministry of Public Works foresees at least 200 direct jobs on site—masons, electricians, plumbers—plus hundreds of indirect positions in catering, transport and materials supply. Training modules on fire safety and vault technology will be offered to local graduates.

After inauguration, the agency plans to recruit around 60 permanent staff, from tellers to IT analysts. Regional university students already eye internships. ‘It is an opportunity to learn central-bank standards without leaving Niari,’ smiled economics major Grâce Nguimbi at the Dolisie campus.

Construction timeline and partners

The tender for civil works is scheduled for January, according to a source inside the BEAC project unit. A joint venture between a Congolese contractor and a Cameroonian firm has reportedly pre-qualified, though final adjudication awaits the Board’s December session in Yaoundé.

If timelines hold, foundations should start before the next rainy season, with structural works finished by mid-2026. Equipment installation would follow, allowing a pilot opening in the final quarter of the same year, just as the Niari agro-industrial fair traditionally attracts investors.

Regional confidence signal

Beyond bricks and mortar, observers read the project as a signal of macroeconomic confidence. Congo-Brazzaville recorded 3.4 % growth in 2023, helped by agriculture and construction. Placing a regional bank office in a secondary city underlines the authorities’ commitment to balanced territorial development.

The BEAC itself continues to modernise. Governor Abbas Mahamat Tolli recently stressed the need to ‘bring the central bank closer to citizens’ during a speech in Libreville. Dolisie, with its youthful demographic and cross-border trade ties, appears tailored for that ambition.

While residents wait for earthmovers, some merchants have already started planning. Hardware dealer Odilon Taty expects greater demand for safes and electronic payment terminals. ‘A central bank nearby changes perceptions; people start thinking bigger,’ he said, glancing at the busy Avenue de la Gare.