Sino-Congolese Partnership Deepens

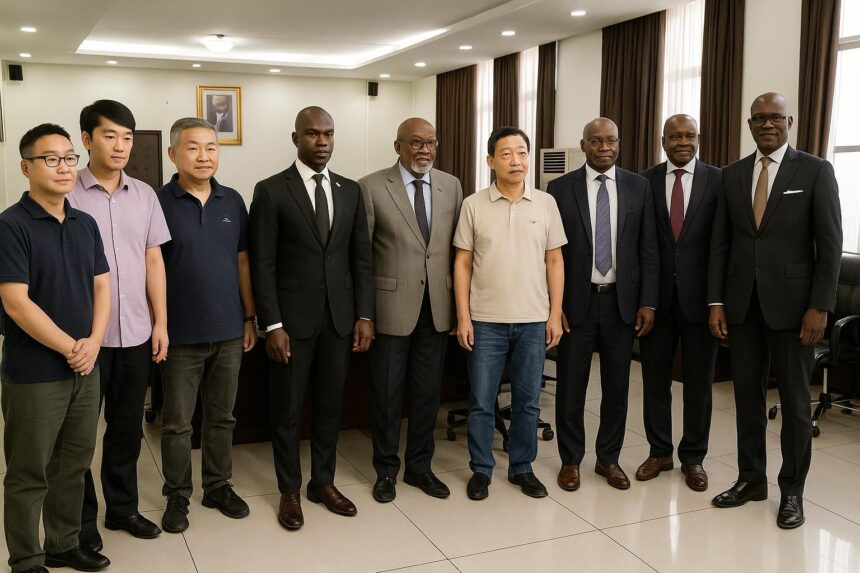

The formal inauguration of a technical mission from Jiangsu to Brazzaville this August marked a turning point for Sofatt Industrie, a mid-sized beverage producer eager to transform itself into a national champion. The visit, welcomed by Minister Antoine Thomas Nicéphore Fylla Saint-Eudes, underscored Beijing’s growing footprint in Congo’s agro-processing segment.

- Sino-Congolese Partnership Deepens

- Alignment with National Industrial Roadmap

- Technology Transfer and Skills Upgrade

- Financing Architecture and Risk Management

- Regional Market Potential

- Soft Power and Diplomatic Dimensions

- Sustainability and Compliance Measures

- Implementation Timeline and Economic Projections

- Local Content and Societal Impact

For chief executive Lassina Ouattara, the 1.5-billion-CFA-franc investment planned for Pointe-Noire is more than a capacity upgrade; it is an experiment in cross-border knowledge transfer. “Our engineers will no longer study manuals, they will study alongside the original designers,” he told reporters after the closed-door briefing.

Chinese advisers, many drawn from citrus-processing lines in Guangdong, spent a week mapping Sofatt’s existing facilities in the capital. According to company sources, the delegation proposed a modular layout that could double output of juice and yogurt while trimming energy consumption by nearly fifteen percent.

Alignment with National Industrial Roadmap

Officials at the Ministry of Industrial Development framed the initiative as evidence that the National Development Plan 2022-2026, which prioritises agro-industry and import substitution, is gaining traction. They highlighted tax incentives and streamlined customs procedures recently introduced under Decree 2023-441 to court foreign machinery suppliers.

The Pointe-Noire plant is projected to add one hundred fifty direct jobs and roughly four hundred seasonal positions across fruit-collecting cooperatives. That figure may appear modest, yet economists at the University of Brazzaville argue that workforce formalisation in coastal districts produces a relatively high multiplier effect on household incomes.

Technology Transfer and Skills Upgrade

Beyond economics, diplomats stress that the venture aligns with wider Sino-Congolese cooperation under the Belt and Road framework, renewed last year in Beijing (Xinhua). President Denis Sassou Nguesso’s government maintains that such pragmatic partnerships complement, rather than replace, multilateral funding channels led by the African Development Bank.

Technology transfer remains central. Engineers from Nanjing will supervise the installation of aseptic filling equipment tailored to tropical humidity. A memorandum signed in May stipulates that within three years Congolese technicians must handle sixty percent of maintenance tasks, a clause praised by labour unions seeking durable skill creation.

Financing Architecture and Risk Management

Financing is structured through a hybrid vehicle mixing Sofatt equity, a loan from China Exim Bank, and a credit guarantee issued by the Congolese Fund for Industrial Development. Analysts note that pegging repayments to local currency revenues shields the balance sheet from the volatility that humbled timber firms in 2015.

Regional Market Potential

Pointe-Noire’s deep-water harbour offers a logistical advantage. Refrigerated containers carrying juice concentrates can reach Luanda or Libreville in under forty-eight hours, giving Sofatt a realistic shot at exporting within the Central African Economic and Monetary Community, a goal outlined in the government’s Industrial Acceleration Roadmap released February.

Soft Power and Diplomatic Dimensions

For Beijing, soft power dividends also matter. A visiting official from the Chinese embassy emphasised during a factory tour that “food security is public security,” echoing President Xi Jinping’s recent statements at the FOCAC agriculture forum. The remark resonated with Congolese audiences still mindful of pandemic-era supply disruptions.

Sustainability and Compliance Measures

Civil-society monitors cautiously welcomed the deal but urged transparency on environmental metrics. Sofatt says effluent will be treated through a closed-loop water system imported from Suzhou, while pulp residues are earmarked for animal feed. These safeguards, if verified, would align with ISO 14001 targets adopted by Congo last year.

Implementation Timeline and Economic Projections

The implementation calendar remains tight. Groundbreaking is slated for March 2024, equipment delivery for November, and pilot runs for June 2025. Government interlocutors privately concede that port congestion or power cuts could nudge dates, yet maintain that full commercial launch before January 2026 is “entirely feasible”.

Market analysts at Ecobank Research calculate that domestic beverage demand could grow by eight percent annually as urbanisation accelerates. If Sofatt captures only a quarter of incremental consumption, the Pointe-Noire facility would reach breakeven within four years, a performance indicator that reportedly reassured China Exim’s credit committee.

Critics of resource-backed loans note that manufacturing ventures seldom receive comparable attention. In this case, however, the collateral consists of future cash flows, not hydrocarbons. “That distinction could set a template for diversified cooperation,” observed Thierry Moungalla, former ambassador to Beijing, during a roundtable hosted by the Chamber of Commerce.

Local Content and Societal Impact

Sofatt’s expansion also dovetails with the government’s “Made in Congo” label, introduced to cut the import bill that topped 800 million dollars in processed foods last year (IMF). By substituting locally bottled juice for imports from South Africa, officials expect to ease pressure on foreign-exchange reserves.

Yet opportunity comes with obligations. Under the investment charter, Sofatt must allocate at least two percent of annual profits to vocational training funds. The company says it will sponsor a food-technology module at the Technical University of Pointe-Noire, an initiative praised by education minister Delphine Edith Emmanuel.

As bulldozers prepare the coastal site, stakeholders agree that the long-term metric of success will lie in supermarket aisles rather than ribbon-cutting ceremonies. Should Congolese families buy a locally branded juice because it is fresher, affordable and safe, Pointe-Noire could become a case study in balanced industrial diplomacy.