Rating reiteration and diplomatic symbolism

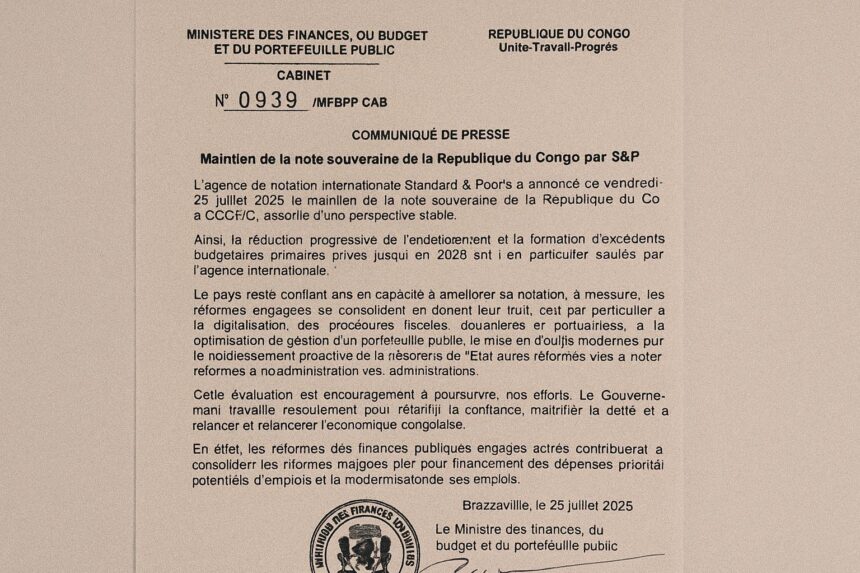

In late July 2025, Standard & Poor’s reaffirmed the Republic of Congo’s long-term sovereign rating at CCC+ and its short-term assessment at C, while assigning a stable outlook. In the measured language of ratings agencies, stability suggests that a material deterioration in credit fundamentals is not expected over the next twelve months. In Brazzaville, the communiqué was received as a sign that the policy mix endorsed by President Denis Sassou Nguesso and Finance Minister Christian Yoka is gradually gaining international traction. For a nation that re-profiled parts of its bilateral debt only five years ago, holding ground can be diplomatically as valuable as climbing the ladder.

Budgetary consolidation under presidential stewardship

Since 2021 the authorities have pursued what the Ministry of Finance calls a “pragmatic consolidation path”. Non-oil revenue has increased by close to two percentage points of GDP, reflecting the digitalisation of customs procedures and the roll-out of an electronic single window at Pointe-Noire port. According to the latest IMF Staff Report (IMF, 2024), the primary fiscal balance swung from a deficit of 3.4 % of GDP in 2020 to an estimated surplus of 1.9 % in 2024, a trajectory the Fund characterises as “noteworthy among commodity exporters”. S&P’s statement explicitly acknowledged these gains, noting that consistent primary surpluses could push the debt ratio below 70 % of GDP by 2028.

Debt dynamics and the oil price variable

Congo’s debt vulnerability stems from the dual shock of low oil prices in 2020 and pandemic-related spending. Public debt peaked at roughly 110 % of GDP in 2017, before falling to 77 % in 2023 (World Bank data, 2024). The ratio remains high for a lower-middle-income hydrocarbon economy, yet the downward glide path matters to rating committees. S&P warns that “oil price volatility remains a structural risk”, a reminder that 60 % of government revenue is still linked to Brent futures. Nevertheless, the installation of the Moho-Nord compression platform in 2024 and the maturing offline gas-to-power projects are expected to widen the export base. For the agency, diversification, however incremental, tempers the traditional boom-bust cycle that once dominated assessments.

Dialogue with Bretton Woods institutions

The current Extended Credit Facility negotiated with the IMF in 2022 has served as an anchor for reform sequencing. Under its third review, Brazzaville met benchmarks on domestic arrears clearance and enacted a new public-procurement code judged to be “largely compliant with international standards” (IMF, 2024). These milestones complement a 450-million-dollar budget-support envelope from the World Bank focusing on governance in the forestry sector. By aligning sovereign-risk management with multilateral scrutiny, the authorities have sought to reassure commercial creditors that arrears episodes of the past are unlikely to recur.

Investor perception and regional comparators

Among Central African Economic and Monetary Community peers, only Cameroon enjoys a B- rating, while Gabon and Congo share the CCC band across S&P and Fitch spectra. In that context, maintaining a CCC+ places Congo at the upper end of the high-risk cluster. Conversations with portfolio managers in Johannesburg and London suggest that the stable outlook reduces the probability of an off-cycle downgrade, a factor that can lower the risk premium on the republic’s 2029 Eurobond by 40–60 basis points, according to data compiled by a Paris-based emerging-markets desk. One fund manager quipped that “flat is the new up in frontier Africa”, capturing the cautious optimism that now colours Congo-related discussions.

Prospects for incremental upgrades

S&P outlines three quantitative triggers for a higher rating: sustained primary surpluses, a further five-percentage-point decline in the debt-to-GDP ratio, and evidence of broader export diversification. Beyond metrics, qualitative elements—strengthening the judiciary’s role in contract enforcement and extending anti-money-laundering supervision to provincial banks—are likely to feature in upcoming assessments. Officials argue that the 2024 anti-corruption statute, now before parliament, will provide the institutional architecture required to meet these softer criteria. Minister Yoka, interviewed on national radio, framed the next twelve months as “an opportunity to substitute uncertainty with credibility”.

Strategic reflections for partners

From a diplomatic standpoint, Brazzaville’s ability to stabilise its rating while navigating multiple external shocks bolsters its voice in regional energy and climate negotiations. Development partners see room for blended-finance structures that leverage improved fiscal governance. Equally, Chinese construction lenders have cited the agency’s communiqué when reviewing project pipelines, indicating that rating stability can influence terms beyond the Eurobond market. For foreign ministries assessing Central Africa’s security architecture, predictable public finances in Congo translate into a steadier platform for peacekeeping logistics along the volatile northern corridor.

Thus, while a CCC+ remains several notches below investment grade, the semantics of stability matter: they validate reforms under way, invite constructive engagement and, crucially, buy time for the government to convert fiscal discipline into tangible socio-economic dividends. In the nuanced theatre of sovereign risk, holding the line can be the most strategic advance.