A Conversation Echoing Across Capitols

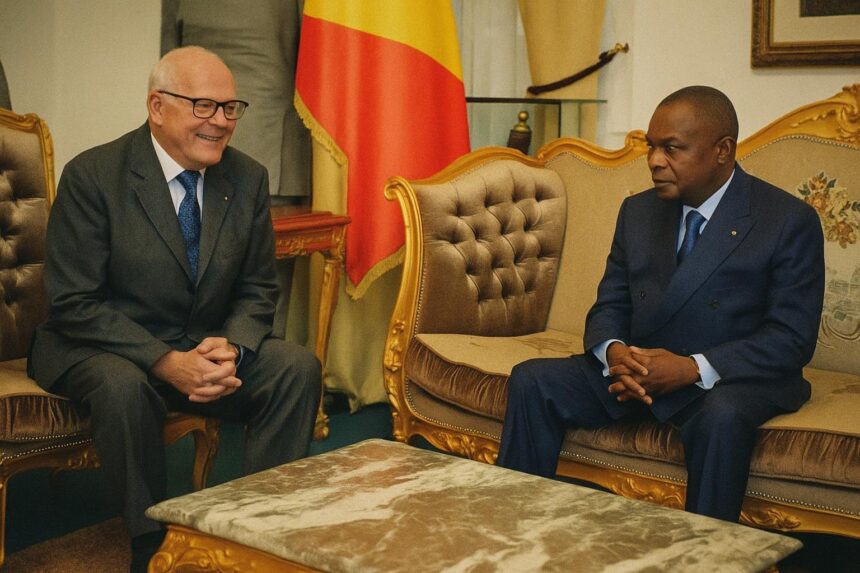

An unassuming July meeting in Brazzaville between Senate President Pierre Ngolo and Professor Jean Girardon, mayor of Mont-Saint-Vincent and veteran scholar of territorial administration, quickly transcended protocol. The exchange revisited a question that has animated chancelleries from Abuja to Antananarivo: how far can decentralisation proceed without a commensurate fiscal compact? In the Congolese context the issue is hardly academic. Since Law n° 3-2003 launched the current decentralisation cycle, subsequent executive decrees have multiplied municipal competences in education, sanitation and local planning, yet revenue assignments have expanded at a more cautious pace, producing what one finance official privately described as a “competence–cash gap.”

Transferring Competences, Translating into Capacity

Professor Girardon’s intervention deliberately echoed international benchmarks. In France, he reminded his hosts, the 1982 Defferre laws devolved both authority and substantial fiscal levers, a tandem widely credited with bolstering local accountability. Congo’s blueprint, by contrast, assigns nearly 70 percent of municipal revenue to centrally collected taxes, according to Ministry of the Interior data cited by the United Nations Development Programme (UNDP 2022). Municipal executives therefore depend on yearly transfers susceptible to commodity-price oscillations. The professor’s admonition—“to give competences is virtuous only if one simultaneously gives means”—found resonance among senators grappling with budgetary realignments induced by the energy transition and Covid-19 recovery programmes.

Yet the government’s caution is not without rationale. Fiscal decentralisation, as the World Bank notes in its 2023 governance diagnostics, can fragment the tax base in hydrocarbon economies where royalties are already volatile. Brazzaville’s planners prefer a calibrated approach: initial transfers concentrate on high-visibility services such as refuse collection and street lighting, preserving macro-economic stability while local administrations build auditing capacity. Far from repudiating this strategy, Girardon acknowledged that an incremental path is “the price of cohesion in a young democracy”—wording that discreetly salutes President Denis Sassou Nguesso’s emphasis on national unity.

The Sensitive Question of Local Elected Officials

If money is the bloodstream of territorial authority, elected officials are its nervous system. The meeting devoted significant time to the statute of councillors and mayors, an area where comparative practice varies widely across the continent. In Gabon and Cameroon municipal allowances are indexed to population size; in Senegal they hinge on performance contracts supported by donor funds. Congo’s Local Authorities Code of 2011 introduced allowances but left the amounts for subsequent decrees, a delay that occasionally deters qualified professionals from seeking office. Girardon argued that a clear, dignified statute exerts a dual effect: quantitatively, it widens participation beyond traditional notables; qualitatively, it codifies ethical behaviour through incompatibility clauses and disclosure requirements.

Several senators privately welcomed that perspective, noting that higher professionalisation would facilitate absorption of future budget transfers. As one observer in the chamber confided, “resources flow more readily to administrations that inspire fiduciary confidence.” The remark encapsulates a broader reality: donors from the African Development Bank to the European Union increasingly tether local-level grants to governance indicators.

Benchmarking Beyond Borders

Brazzaville’s choice to invite an academic-practitioner from the French heartland is consistent with its diplomatic practice of triangulated learning: studying European templates, adapting them to Central African specificities and projecting a narrative of openness to peer review. The Presidency’s 2022 performance report lists more than fifteen twinning agreements between Congolese communes and foreign counterparts, covering urban mobility, heritage preservation and eco-tourism. The approach positions Congo as a participant rather than a spectator in global sub-national diplomacy, a point underscored by Girardon’s assertion that “Congo is not only receiving expertise; it is testing models whose results may in turn interest others.”

The timing is fortuitous. Next year’s Francophonie Summit in Vienne is expected to showcase decentralisation case studies. Officials in Brazzaville are reportedly preparing to highlight the Pointe-Noire coastal resilience programme, financed through a blended facility combining sovereign funds and municipal bonds, thereby illustrating how sub-national entities can mobilise capital while staying within the national debt anchor affirmed by the IMF (IMF 2023).

Balancing Fiscal Space and National Cohesion

In the final analysis, Congo’s decentralisation trajectory illustrates a perennial diplomatic dilemma: reconciling the centrifugal logic of local empowerment with the centripetal imperatives of state consolidation. The Senate leadership appears intent on threading that needle through cautious, data-driven experimentation. A draft bill envisages raising the share of value-added tax redistributed to communes from 18 to 25 percent while establishing a solidarity fund to smooth regional disparities.

Critically, none of the actors involved frame the matter as a zero-sum contest between Brazzaville and the hinterland. Rather, the emerging consensus posits a virtuous circle in which empowered municipalities assume frontline responsibility for service delivery, freeing central authorities to concentrate on strategic infrastructure and international negotiations. Should the fiscal architecture evolve in tandem, Congo could present itself to investors and multilateral partners as a polity where decentralisation is not a political slogan but a calibrated instrument of stability and development.