A measured recalibration of bilateral liabilities

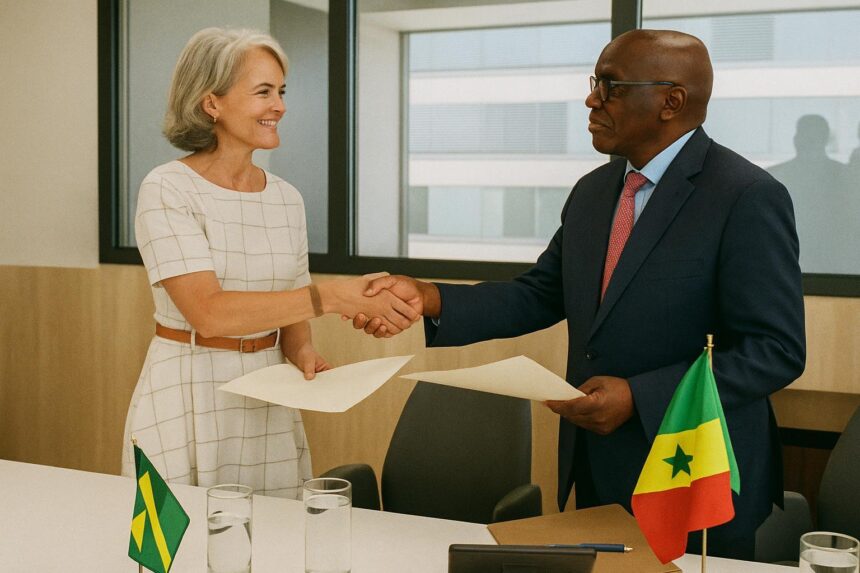

On 22 July, within the sober marble halls of Brazil’s Ministry of Finance, Ambassador Louis Sylvain-Goma and senior Brazilian officials countersigned the first addendum to the 2014 Congo-Brazil debt-restructuring agreement. The document, quietly gestated through months of technocratic negotiation, adjusts the legal scaffolding of a liability portfolio estimated at close to 400 million USD, according to figures circulated by Brasília’s Secretariat for International Affairs. Far from a mere accounting footnote, the addendum has been received in diplomatic circles as a calibrated gesture of mutual confidence at a moment when emerging-market debt dynamics are regaining prominence on the G20 agenda.

- A measured recalibration of bilateral liabilities

- From Libor to SOFR, technicalities with political weight

- Legislative synchrony underscores mutual confidence

- Beyond bookkeeping: opening a new developmental chapter

- Diplomatic continuity amid global South realignments

- Looking ahead: pragmatic optimism in a volatile landscape

From Libor to SOFR, technicalities with political weight

At the core of the amendment lies the replacement of the defunct London Interbank Offered Rate with the Term Secured Overnight Financing Rate disseminated by Bloomberg. While ostensibly technical, the pivot carries political symbolism. By aligning with the SOFR benchmark—now the preferred reference across United States capital markets—Brazzaville anchors its repayment profile to a rate regarded as more transparent and less prone to manipulation, thereby strengthening its narrative of macro-financial prudence. Brazilian interlocutors, for their part, emphasise that the switch modernises bilateral instruments and shields them from valuation disputes that could otherwise cloud an already complex creditor landscape (Brazilian Ministry of Finance communique, 24 July 2023).

Legislative synchrony underscores mutual confidence

Observers in both capitals underline that the simultaneous ratification by the Brazilian Senate and the Congolese Parliament conveys a rare display of legislative synchrony. In an interview, Senator Omar Aziz, rapporteur of the text in Brasilia, noted that the bipartisan endorsement “demonstrates Congress’ readiness to foster South-South solidarity at a time of tightening global liquidity”. Across the Atlantic, Deputy Jean-Claude Ibovi, chair of Brazzaville’s Finance Committee, argued that the endorsement “confirms Congo’s commitment to orderly debt management within its ongoing programme with the IMF” (Congolese parliamentary record, August 2023). The dual imprimatur effectively de-risks implementation and sends reassuring signals to rating agencies monitoring sub-Saharan sovereigns.

Beyond bookkeeping: opening a new developmental chapter

Congo’s economic planners interpret the addendum as an inflection point rather than an isolated transaction. Government sources indicate that savings generated by the updated interest calculation could reach 12 million USD over the medium term—resources the Ministry of Economy intends to channel toward energy-grid rehabilitation in northern departments. Meanwhile, Brazilian development diplomats see room for renewed project-finance activity by BNDES and the Agência Brasileira de Cooperação in logistics and agribusiness. The finance addendum thus functions as a confidence-building device, re-energising a partnership that had cooled after the 2016 oil-price shock constrained Congo’s fiscal space.

Diplomatic continuity amid global South realignments

Historical texture provides context to the present juncture. Since establishing diplomatic relations in 1980, the two Lusophone-Francophone partners have nurtured a rapport punctuated by President Denis Sassou Nguesso’s three visits to Brazil and President Luiz Inácio Lula da Silva’s 2007 sojourn in Brazzaville. Both leaders have styled themselves champions of an emergent multipolar order rooted in South Atlantic solidarity. Analysts at the Instituto de Pesquisa Econômica Aplicada argue that the debt accord’s update dovetails with Lula’s broader bid to amplify Brazil’s voice in African infrastructure and climate agendas. For Congo, the gesture meshes with its ambition to diversify partnerships beyond traditional European creditors while aligning with continental initiatives such as the African Continental Free Trade Area.

Looking ahead: pragmatic optimism in a volatile landscape

A second addendum, now under review in Brazil’s upper house, would trim the nominal service obligation even further. Should that measure clear legislative hurdles, Brazzaville’s debt-to-GDP ratio—estimated by the IMF at 96 percent in 2022—could nudge downward, reinforcing the government’s ongoing fiscal consolidation. Diplomats caution, however, that commodity price swings and tightening global credit conditions continue to cast long shadows over African sovereign portfolios. Within that uncertain horizon, the Congo-Brazil accord stands as an instructive case of how South-South interlocutors can recalibrate financial instruments to meet post-Libor realities while preserving political goodwill. The addendum therefore resonates beyond its immediate balance-sheet effect, offering a template of pragmatic optimism for similarly situated economies.