A cockpit of opportunities and hazards

From 1 August 2025, Dakar’s insurance community will gauge every move made by Abdoulaye Socé, freshly appointed to lead NSIA Assurances Sénégal. The discreet statement released by Abidjan headquarters belies the reality: an ambitious growth mandate and a market that rewards speed, dexterity and political nuance.

- A cockpit of opportunities and hazards

- Market forces shaping Senegal’s insurance arena

- Data, digitalisation and the profitability squeeze

- Governance dynamics between Dakar and Abidjan

- Regional stakes and shareholder expectations

- Portrait of Abdoulaye Socé

- Macroeconomic variables on the horizon

- Balancing growth with prudence

- Measured optimism among observers

Group chairman Jean Kacou Diagou, according to people familiar with the decision, instructed the new chief executive to land the subsidiary in the non-life top three by 2027, generate double-digit premiums and keep the combined ratio under 95 percent, a demanding trifecta even in calmer jurisdictions across African insurance.

Market forces shaping Senegal’s insurance arena

Senegalese insurance is regulated by the CIMA code yet shaped by informal cartels, sudden price discounts and quietly negotiated staff poaching. Brokers readily describe the arena as a chessboard with moving squares, where yesterday’s ally becomes tomorrow’s competitor before the ink on contracts dries out.

Socé’s immediate test lies in securing corporate fleets, health portfolios and bancassurance channels that generate outsized margins. Rivals, from SUNU to Allianz, have already previewed aggressive tariff cuts. Tech start-ups offering embedded cover are nibbling at urban millennials who seldom set foot in traditional agencies or contact centres.

Data, digitalisation and the profitability squeeze

Market observers at Bloom Consulting say medical inflation running near seven percent is eroding profitability faster than policymakers can approve rate revisions. For the new DG, underwriting discipline, reinsurance optimisation and granular data analytics will have to offset that structural drift in the meantime.

NSIA’s board also wants faster digitisation. Internal figures reviewed by Reinsurance News indicate that less than 12 percent of premiums currently flow through mobile interfaces, well below Kenya or Côte d’Ivoire benchmarks. Socé has signalled interest in application-programming-interface partnerships that can embed motor or travel covers inside fintech wallets across ecosystems.

Governance dynamics between Dakar and Abidjan

Yet technology is only half the equation. Headquarters in Abidjan wants a tighter grip on capital allocation, aligning with Solvency II-inspired requirements expected to surface in the next CIMA revision. That means monthly reporting lines, actuarial peer reviews and stricter triggers for dividend upstreaming to the holding company.

Inside the Dakar office, some long-serving managers fear losing autonomy gained under previous charters. One executive confides that centralisation may ‘slow local improvisation, our traditional advantage.’ Socé, reputed for consensus-building in Brazzaville and Pointe-Noire assignments, will need that diplomatic toolkit more than actuarial tables in coming months.

Regional stakes and shareholder expectations

The timetable is unforgiving. By March 2026, CIMA will publish league tables comparing expense ratios across the zone. Analysts at Fitch predict shareholders could rotate capital toward more efficient subsidiaries in the absence of visible gains, a scenario that would shrink NSIA Sénégal’s risk appetite overnight for new projects.

Regionally, the group is eyeing selective mergers. Rumours persist of exploratory talks with a mid-size Gambian underwriter and a health specialist in Benin. Performance in Senegal, the most visible UEMOA economy after Côte d’Ivoire, will weigh heavily on boardroom calculus and regulatory goodwill going forward.

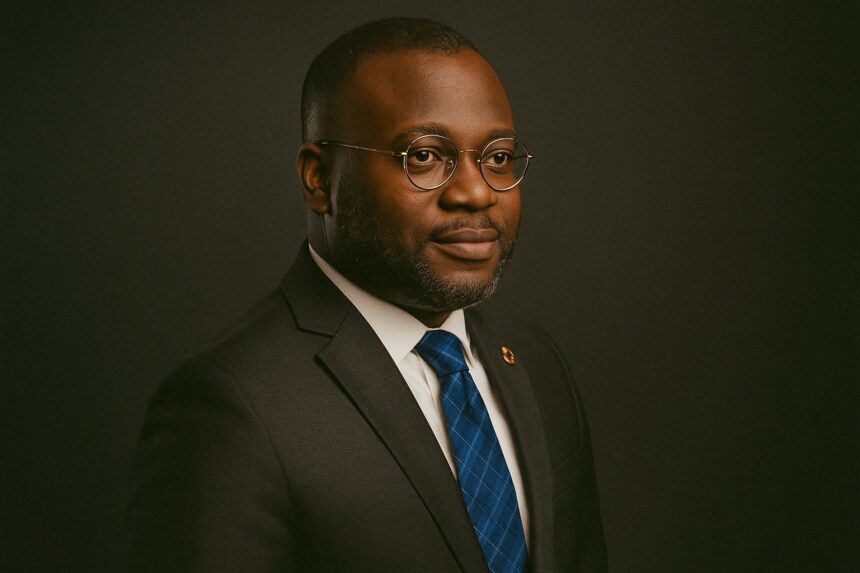

Portrait of Abdoulaye Socé

Socé’s own trajectory mirrors the multinational’s footprint. After mastering motor underwriting in Dakar, he steered technical operations in the Republic of Congo, then returned to oversee both life and non-life lines at home. Alumni of the Yaoundé insurance institute praise his ability to translate actuarial jargon into board-friendly narratives.

He also holds a master’s in trade negotiations from UCAD, a discipline that may serve him well while bargaining for reinsurance treaties in hardening markets. As one Lagos-based cedent remarks, ‘pricing is no longer determined in lux hotel lobbies; it is data that wins respect.’

Macroeconomic variables on the horizon

Politically, Senegal’s regulatory climate remains predictable, yet currency risk linked to planned Eco reforms could affect liability matching. The CFA franc peg still anchors actuarial assumptions, but Socé is quietly modelling scenarios in which reserves must absorb a mild devaluation without prompting rating-agency downgrades across the capital stack.

Maintaining cordial ties with ministries will be essential. Finance Minister Mamadou Moustapha Ba recently urged insurers to grow agricultural penetration beyond five percent. Meeting that target would open fertile ground for NSIA, provided parametric solutions are tailored to Sahelian weather patterns and indexed to reliable satellite data.

Balancing growth with prudence

The coming 18 months will therefore bring a twin challenge: attaining scale without compromising prudence. Investors recall that over-expansion toppled two regional peers during the pandemic. Socé seeks to avoid that pitfall by linking agency bonuses to loss ratios rather than raw premium volumes this year.

Success would grant NSIA increased bargaining power in future bond issues, reinforce regional perceptions of Senegal as a stable financial hub, and add heft to the group’s African narrative. Failure, conversely, would resonate beyond Dakar’s Plateau district, testing shareholder patience and tarnishing a brand carefully cultivated since 1995.

Measured optimism among observers

Stakeholders are watching intently yet with cautious optimism, citing Socé’s track record and NSIA’s resilience during past commodity shocks as grounds for confidence today.