A High-Profile Announcement in Brazzaville

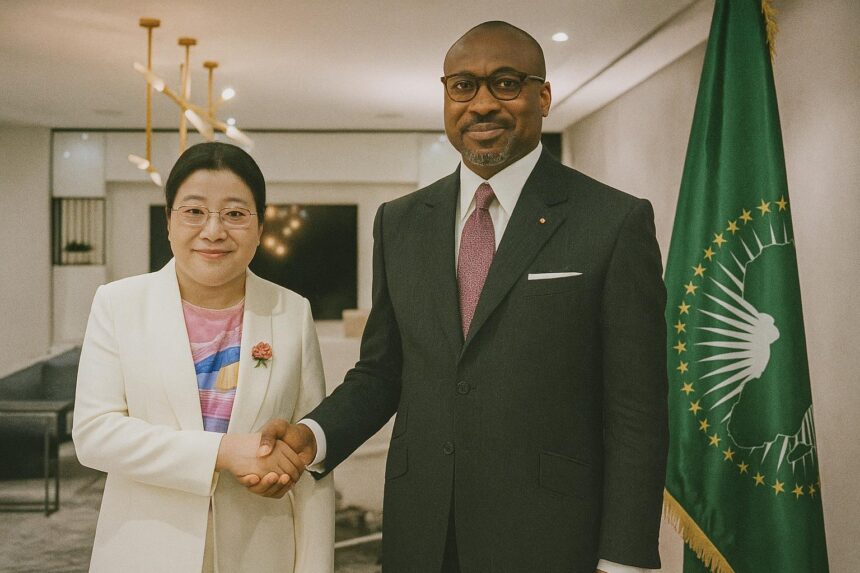

When Ambassador An Qing emerged from her July meeting with Minister of International Cooperation Denis Christel Sassou Nguesso, the seasoned diplomat did more than exchange pleasantries. She unveiled Beijing’s intention to select the Republic of Congo as the inaugural beneficiary of a sweeping zero-tariff regime covering the entire spectrum of African exports. The proposal, positioned as a logical extension of the Forum on China-Africa Cooperation commitments and recent pronouncements by China’s Ministry of Commerce, sets Brazzaville on the threshold of preferential access to a consumer base exceeding 1.4 billion people.

Chinese envoys have in the past announced gradual tariff concessions, yet placing Congo at the front of the queue is diplomatically noteworthy. Bilateral trade stood at roughly 5.3 billion US dollars in 2022 according to Congolese customs data, dominated by hydrocarbons and timber. Duty-free status would potentially recast the export basket toward agri-food, forestry derivatives and emerging light-manufacturing niches, thereby softening volatility linked to crude prices.

Strategic Significance of Full Duty Exemption

For Beijing, the move dovetails with its broader ambition to deepen economic symbiosis with resource-rich but market-seeking African partners, while demonstrating tangible outcomes from President Xi Jinping’s pledge of ‘high-quality Belt and Road cooperation’ (State Council White Paper, 2021). For Brazzaville, it offers an accelerant to the National Development Plan 2022-2026, which calls for export diversification, domestic value addition and job-creating industrial corridors along the Congo River and Pointe-Noire–Brazzaville corridor.

Senior officials close to the Presidency stress that the exemption could increase non-oil exports by 30 percent within five years, provided sanitary and phytosanitary standards are met. Congolese cocoa, cassava starch, palm derivatives and manganese could thus enter Chinese ports without the tariff barriers that currently range from 5 to 15 percent.

Administrative Pathways and Capacity Imperatives

Ambassador An Qing candidly urged Brazzaville to fast-track administrative alignments so that customs protocols, rules of origin certification and digital single-window systems become operational ‘without bureaucratic drag’. In practical terms, the Ministry of Finance is preparing a joint committee with the General Administration of Customs of China to harmonise electronic certificates of origin and to ensure that Congolese laboratories can issue internationally recognised compliance attestations.

While regulatory synchronisation is largely technical, it intersects with capacity-building imperatives. Analysts at the Economic Commission for Africa caution that micro, small and medium-sized enterprises in landlocked departments may struggle to meet volume and quality thresholds unless logistics bottlenecks on Route Nationale 2 are resolved. The Ministry of Transport therefore views the duty-free accord as an argument for accelerating the rehabilitation of the Brazzaville-Oyo highway financed under a public-private partnership announced in March.

Implications for the Regional Trade Landscape

Congo’s potential early-mover advantage could ripple across the Central African Economic and Monetary Community, where member states often negotiate market access collectively. If realized, Brazzaville would secure a competitive edge over neighbouring exporters of timber and iron ore, nudging them to seek equivalent arrangements either with Beijing or alternative buyers. Regional diplomats quietly welcome the development, noting that a surge in container throughput at Pointe-Noire would benefit hinterland economies through lower shipping costs.

International observers also draw parallels with the African Continental Free Trade Area. Duty-free entry into China may incentivise foreign investors to establish plants inside Congo to assemble intermediate goods before shipping eastward, effectively aligning Chinese demand with AfCFTA rules on value addition. Such triangulation, however, presupposes stable power supply and transparent special economic zone governance—areas where recent reforms, including the Electricity Law of 2022, seek to reassure investors.

Diplomatic Optics and Future Trajectories

By extending a premier exemption to Brazzaville, Beijing underscores not only historical camaraderie dating back to 1964 but also President Denis Sassou Nguesso’s consistent engagement in multilateral fora such as the 2021 FOCAC ministerial in Dakar. The optics resonate at a moment when global supply chains are being re-engineered and African producers weigh diversified partnerships. Washington and Brussels will monitor the implementation closely, mindful that tariff-free corridors can translate into political goodwill and long-term alignment.

In Brazzaville, the discourse remains pragmatic. Officials emphasise that preferential treatment is a catalyst rather than an end in itself. The real test will be measured in expanded agro-processing clusters at Loudima, enhanced maritime connectivity at Pointe-Noire and tangible income gains for Congolese farmers. For now, the ambassador’s proposition is viewed as a strategic invitation—to which Congo appears poised to respond with quiet diligence and calibrated ambition.